20 Pro Suggestions For Choosing Ai Stock Pickers

20 Pro Suggestions For Choosing Ai Stock Pickers

Blog Article

Top 10 Tips For Regularly Monitoring And Automating Trading Stock Trading From Penny To copyright

In order for AI stock trading to succeed, it is vital to automatize trading and ensure regular monitoring. This is especially important when markets are moving quickly such as penny stocks or copyright. Here are ten tips for automating and monitoring trading to ensure that it is performing.

1. Set clear and precise goals for trading

It is important to establish your trading goals. This should include returns expectations, risk tolerance and asset preferences.

What is the reason: Specific objectives should guide the choice and implementation of AI algorithms.

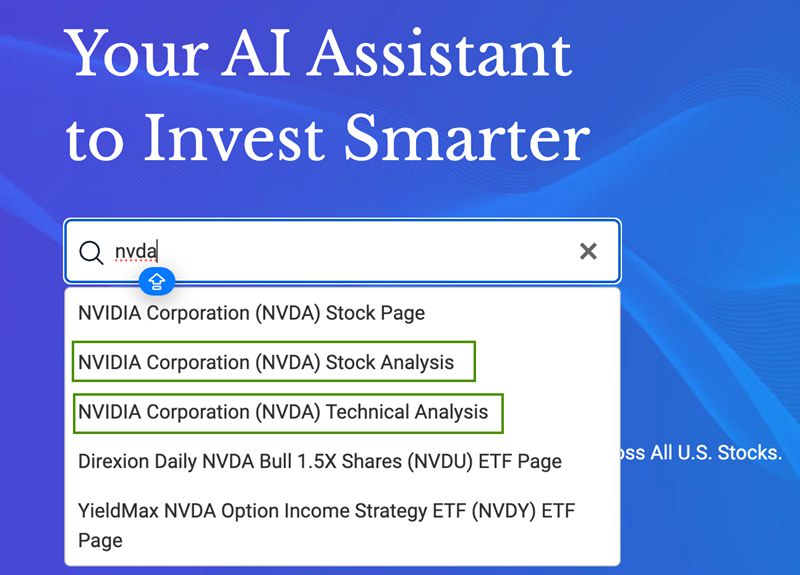

2. Trustworthy AI Trading Platforms

Tip: Look for trading platforms based on AI that are fully automated and integrated to your broker or exchange. Examples include:

For Penny Stocks: MetaTrader, QuantConnect, Alpaca.

For copyright: 3Commas, Cryptohopper, TradeSanta.

Why: Automation success depends on a strong platform and execution capabilities.

3. Customizable Trading algorithms are the main focus

Make use of platforms that permit you to create or customize trading algorithms that are customized to your particular method (e.g. mean reversion or trend-following).

The reason: A custom algorithm makes sure that the strategy matches your specific trading style.

4. Automate Risk Management

Set up automated tools to manage risk like taking-profit levels, as well as stop-loss order.

The reason: These security measures are designed to safeguard your portfolio of investments from massive losses. This is especially important when markets are volatile.

5. Backtest Strategies Before Automation

Tips: Test the automated algorithm to determine the performance prior to the launch of your.

The reason: Backtesting can help determine if a plan is viable, and thus reduces the possibility of failing on live markets.

6. Review performance on a regular basis and make adjustments settings

Tips: Even though trading is automated examine performance to spot any issues or suboptimal performance.

What to watch for What to watch for: Loss, profit slippages, profit and whether the algorithm is aligned with market conditions.

Why: Monitoring the market continuously allows timely adjustments when conditions change.

7. Adaptive Algorithms to Apply

Tips: Choose AI tools that adjust trading parameters according to the latest data. This allows you to adapt the settings of your AI tool to the changing market conditions.

The reason: Markets change and algorithms that are adaptive can optimize strategies for penny stocks and copyright to adapt to new trends or fluctuations.

8. Avoid Over-Optimization (Overfitting)

Tips: Beware of over-optimizing automated systems based on previous data. It could lead to the overfitting of the system (the system might work very well in back-tests however, it may not perform as well in real conditions).

The reason: Overfitting decreases the strategy's ability to generalize to the market's future conditions.

9. AI for Market Analysis

Tips: Make use of AI to detect unusual market patterns or anomalies in the data (e.g. sudden increases in the volume of trading, news sentiment or the activity of copyright whales).

Why: Recognizing these signs early will aid in adjusting automated strategies prior to a major market move happens.

10. Integrate AI to provide regular alerts & notifications

Tips: Set alerts in real-time to be notified of major market events, trading executions or modifications to algorithm performance.

The reason: Alerts inform you of critical market movements and enable swift manual intervention should it be needed (especially in volatile markets such as copyright).

Make use of cloud-based solutions to scale.

Tip: Use cloud-based platforms to boost speed and scalability. It is also possible to use multiple strategies simultaneously.

Why? Cloud solutions let your trading system work 24/7 all year round and at no cost. They are particularly beneficial in the copyright market because they never close.

Automating and monitoring your trading strategies, you can improve performance and minimize risk making use of AI to manage stock and copyright trading. Read the top rated ai trading platform recommendations for more info including ai stock market, ai stock price prediction, trade ai, ai stock trading app, best ai trading bot, ai penny stocks, best ai penny stocks, ai investing app, stock ai, ai trading and more.

Top 10 Tips To Improve Quality Of Data In Ai Stock Pickers, Predictions And Investments

It is crucial to focus on the quality of data for AI-driven stock picks investment predictions, forecasts, and stock picking. Quality data will ensure that AI models make accurate and reliable decisions. Here are 10 suggestions to ensure the quality of data for AI stock-pickers.

1. Prioritize data that is clean and well-structured.

TIP: Make sure that your data is clean free of errors, and arranged in a uniform format. This means removing duplicate entries, dealing with missing values, assuring data integrity, etc.

The reason: AI models can process information better with structured and clean data. This results in better predictions, and less mistakes.

2. Timeliness of data and real-time data are crucial.

Tip: Use up-to-date live market data to make forecasts, such as the price of stocks, trading volumes Earnings reports, stock prices, and news sentiment.

Why? Timely data is essential to allow AI models to reflect current market conditions. This is especially true in volatile markets such as penny stock and copyright.

3. Data from trusted providers

Tips: Choose reliable data providers to get the most fundamental and technical data, like financial statements, economics reports, and price feeds.

Why: By using reliable sources, you can minimize the chance of data inconsistencies or mistakes that may undermine AI models' performance. This can result in inaccurate predictions.

4. Integrate multiple data sources

Tip: Combine different data sources like financial statements, news sentiment data from social media, macroeconomic indicators, and technical indicators (e.g., moving averages, RPI).

Why? A multi-source approach gives a complete perspective of the market and lets AI to make informed decisions by analyzing the various aspects of its behavior.

5. Focus on Historical Data for Backtesting

TIP: When testing AI algorithms It is crucial to collect high-quality data to ensure that they perform well under various market conditions.

Why Historical Data is important: It helps in the refinement of AI models. It is possible to test trading strategies in a simulation to evaluate potential returns and risks and make sure that you have AI predictions that are robust.

6. Validate data continuously

Tip: Regularly review and verify the quality of data by checking for inconsistencies and updating information that is out of date, and verifying the accuracy of the data.

What is the reason? Consistent validation of data reduces the risk of inaccurate predictions resulting from outdated or faulty data.

7. Ensure Proper Data Granularity

Tips Choose the right degree of data granularity that is appropriate for your specific strategy. For instance, you could use minute-by–minute data in high-frequency trades or daily data for long-term investments.

Why: The correct granularity will help you achieve the goals of your model. For example, short-term strategies are able to benefit from data with an extremely high frequency, whereas longer-term investing needs more comprehensive data with a lower frequency.

8. Incorporate Alternative Data Sources

TIP: Consider other sources of data such as satellite imagery, social media sentiment, or scraping websites of news and market trends.

What is the reason? Alternative data could give your AI system unique insights about market behaviour. It can also assist it compete by identifying patterns that conventional data could have missed.

9. Use Quality-Control Techniques for Data Preprocessing

Tip. Use preprocessing techniques such as feature scaling, data normalization or outlier detection, to enhance the accuracy of your data before you put it into AI algorithms.

Preprocessing properly ensures that the AI model is able to interpret the data correctly, reducing errors in predictions and enhancing overall performance of the model.

10. Monitor Data Drift and Adapt Models

Tips: Track data drift to determine whether the nature of data change over time, and then adjust your AI models accordingly.

The reason: Data drift can adversely affect model accuracy. By adjusting and detecting changes to data patterns, you can make sure that your AI model is working over time. This is especially true in markets such as the penny stock market or copyright.

Bonus: Maintain an Information Loop to Ensure Improvement

Tips : Create a continuous feedback loop, in which AI models constantly learn from the data and results. This improves data processing and collection techniques.

The reason: Feedback systems allow for the improvement of information in the course of time. It also makes sure that AI algorithms are evolving to adapt to market conditions.

Quality of data is crucial to maximize AI's potential. Clean, high-quality, and timely data ensures that AI models can generate accurate predictions that result in better decision-making about investments. Following these tips will make sure that you've got the best data base for your AI system to predict and make investments in stocks. Check out the most popular ai for stock market examples for blog examples including copyright ai bot, penny ai stocks, incite ai, ai sports betting, best stock analysis website, trading bots for stocks, best ai trading app, ai financial advisor, ai for trading, stock trading ai and more.